Adding to the existing financial support for businesses affected by the pandemic, the Chancellor announced on 5th January 2021 that £4.6 billion in new lockdown grants would be made available.

£4.6 billion in new lockdown grants

As the UK entered its third nationwide lockdown, Chancellor Rishi Sunak announced a new set of support grants worth up to £9,000 for businesses in the retail, hospitality, and leisure sectors.

These grants will be delivered as a one-off and don’t need to be paid back. Any business that has legally been required to close and which cannot operate remotely is eligible.

The amount you receive is worked out on a per-property basis, taking into account the value of your business:

- £4,000 per property for companies with a rateable value of £15,000 or under

- £6,000 per property for those with a rateable value between £15,000 and £51,000

- £9,000 per property for those with a rateable value of over £51,000

For more information, visit the gov.uk page.

Changes to the Job Support Scheme

Update 11/01/2021: The Job supports scheme has now been extended until the end of April 2021. The Government will cover the cost of 80% of the wages of furloughed employees for hours not worked. Employers will still need to cover NICs and pension contributions.

Update 12/11/2020: The Job Support Scheme has been postponed as the Coronavirus Job Retention Scheme has been extended until March 2021.

The Job Support Scheme (JSS) was introduced to replace the furlough scheme as of November, aiming to provide support to workers who have worked less than their usual hours as a result of reduced demand due to the pandemic.

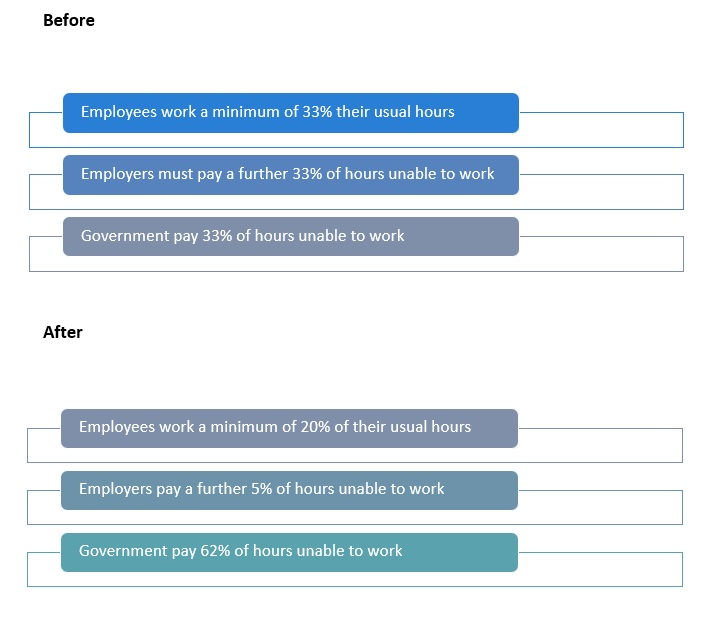

Previously, employees would have had to work at least 33% of their usual hours, with employers paying for the hours worked along with 33% of their usual hours not worked as well as the Government covering a further 33%.

On the 22nd October 2020, however, changes to the JSS were announced: employees must now work at least 20% of their usual hours to qualify for the JSS and employers need to contribute 5%, resulting in the Government paying 62% of workers wages.

Employers are still expected to cover National Insurance (NI) and pension contributions.

This scheme is open to both small and large businesses – all companies are eligible regardless of which coronavirus tier they sit in and whether or not they have previously applied to use the furlough scheme.

There are further changes for business in tier 3 (see below for more information)

Support for business in tiers 2 & 3

For businesses that have been affected by being in tier 2 area restrictions, there will be cash grants available. Business in the hospitality, accommodation or leisure sectors will be able to claim up to £2,100 per month.

For businesses in tier 3, there are further changes to the job support scheme: the Government will cover 67% of workers usual wages and employers will not have to pay anything. However, employers must still pay NI and Pension contributions.

Self-employed support

It was previously announced that self-employed workers could claim a grant covering 20% of average monthly profits up to a cap of £1,875 for 3 months. This has been increased to 40%, so workers can now claim up to £3,750. An additional second grant will be available to cover February – April, although the Government has yet to announce how much this grant will cover.

For any further information about coronavirus support and what it means for you and your business, contact us today.

No Comments