The government announced changes to national insurance this week to fund social care in England. Read on to find out how this may affect you.

What is national insurance?

National insurance is a tax paid on earnings and self-employed profits. This tax is then used to fund various state benefits such as state pension, statutory sick pay, and maternity pay. You will have to pay national insurance for a set number of years before you can claim state pension. National Insurance is paid by employers, employees, and self-employed workers. Currently, once you reach state pension age you no longer need to pay National Insurance. If you’re employed, national insurance is automatically deducted from your pay just like PAYE however if you are self-employed you will need to organise these yourself through your yearly tax return.

Why is it changing?

The government are hoping to raise an extra £12bn a year to help ease the pressure on the NHS due to the pandemic. A proportion of these extra funds will then go into the social care system over the next three years to make sure people in England pay no more than £86,000 in care costs from October 2023. Anyone with assets, savings or investments which are worth less than £20,000 will have their care fully covered by the state and those with assets between 20,000 to £100,000 will have their care costs subsidised.

What is changing?

From April 2022, employers, employees, and those self-employed will have to pay 1.25% more in National Insurance in a bid to help fund social care in England. However, from April 2023, National Insurance will return to its current rate and the extra tax will be collected as a new health and social care levy. The new levy will apply to all employed workers, self-employed and state pensioners who are still working or self-employed with profits above £9,568. This levy will be collected the same way as National Insurance.

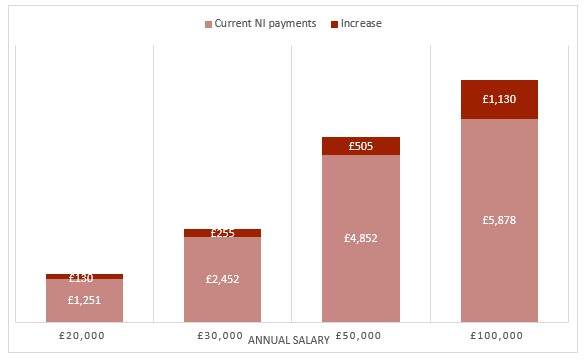

How much extra will you have to pay?

Currently, people pay 12% on earnings between £9568 and £50,270 and 2% on any income above £50,270. With this now rising by 1.25% you can see the payments you can be expected to make from 2022 below:

If you need any help or advice with National Insurance, please get in contact with us and we will be happy to help.

No Comments