Tips for keeping contractor and subcontractor accounting records

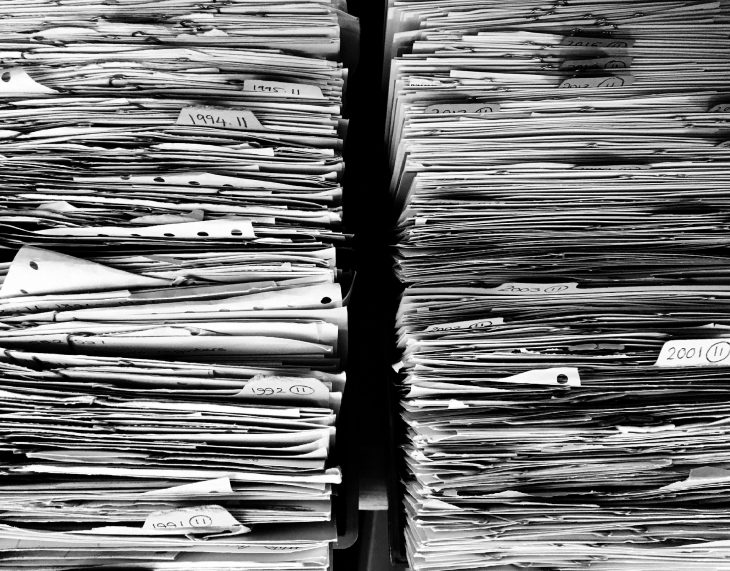

Keeping good accounting records can seem like a daunting task for any contractor. It can take time to get your records in order and can result in a lot of unnecessary stress. Here are some top tips on how to keep good accounting records.

Recent Comments